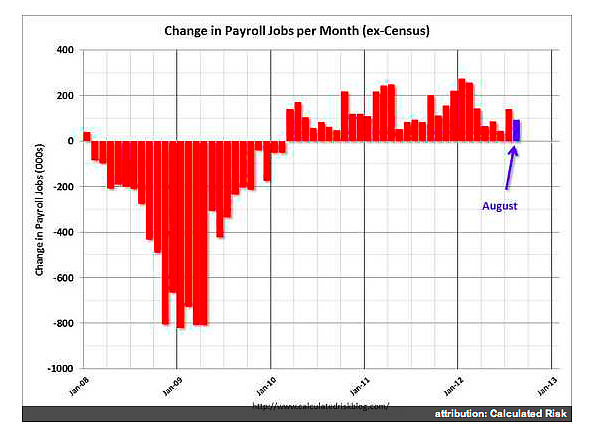

The U.S. has enjoyed 30 months of straight jobs growth. The August 2012 report was more tepid, however, than analysts had predicted.

Friday, September 7, 2012

NEW YORK (AP) — Stocks on Wall Street are edging between small gains and losses following news that the U.S. economy added fewer jobs than expected in August. Analysts had predicted about 125,000 new jobs in August, but 103,000 were created with 7,000 government jobs eliminated, resulting in a net gain of 96,000 jobs.

The number of new jobs in August is about the same number of new workers entering the labor force—but is not high enough to help lower the existing unemployment problem.

The unemployment rate fell to 8.1 percent from 8.3 percent, but only because more people gave up looking for work.

The Dow Jones industrial average was down six points at 13,286 at midday Friday. The Standard & Poor's 500 was up nearly four at 1,436. The Nasdaq was down less than two points at 3,134.

Tech bellwether Intel dealt the market a blow by cutting its revenue outlook because of weak demand for its semiconductors. Intel fell 84 cents, or 3 percent, to $24.25.

The flat trading Friday for the major indexes followed big gains Thursday. U.S. stocks hit four-year highs after the European Central Bank announced plans to buy an unlimited amount of short-term government bonds from struggling countries in the region such as Italy and Spain. The hope is that the borrowing costs of those countries will ease, making a breakup of the 17-nation euro zone less likely.

The weak jobs report in the U.S. increased expectations that the Federal Reserve could announce more steps at its meeting next week to encourage lending and keep interest rates low by buying Treasury bonds.

Analysts from RBS wrote in a note to investors that they now see the likelihood of the Fed announcing new asset purchases next week at 90 percent. "We expect the Fed to act in September," they wrote.

Bond prices rose as a result, sending their yields lower. The yield on the benchmark 10-year Treasury note fell to 1.63 percent from 1.67 percent late Thursday.

Overseas, the new bond-buying plan by the European Central Bank sent stocks up sharply. The Hang Seng index in China rose 4 percent, and Japan's Nikkei rose 2 percent.

Most major markets in Europe are rising, too. Benchmark indexes rose 0.7 percent in Germany and 0.3 percent in France. Italy's main index rose 4 percent.

In U.S. trading, energy stocks rose 1.5 percent, the biggest gain among the S&P 500's ten industry sectors. The biggest losers were telecommunication companies, down 1.1 percent.

Among stocks making big moves, Amazon rose $7.09, or 2.8 percent, to $258.47. The company unveiled four new Kindle tablet computers Thursday, including ones with larger color screens.

Smith & Wesson rose $1.16, or nearly 13 percent, to $10.16 on surging gun sales and a raised profit forecast. The gun company said it expects earnings for the quarter ending October to climb to as much as twice what analysts had expected.

Dell rose 13 cents, or 1.2 percent, to $10.65 after announcing it would pay a dividend of eight cents per share in October. It is the computer maker's first cash dividend.

Glencore International fell 14 cents, or nearly 4 percent, to $3.78. The commodities trader said it is prepared to raise its offer to buy mining company Xstrata PLC. Xstrata rose 35 cents, or nearly 4 percent, to $10.14.

The Jackson Free Press contributed to this report.

Comments

Use the comment form below to begin a discussion about this content.

Sign in to comment

Or login with:

OpenID