After the COVID-19 pandemic forced local business owner Mitchell Moore to shutter three of his restaurants, he has baked and sold bread and other goods to support his employees. Courtesy Mitchell Moore.

Saturday, April 4, 2020

Jackson restaurateur Mitchell Moore had to shut down all three of his businesses after people stopped coming in because of the COVID-19 outbreak. Like many other business owners throughout the Jackson area, Mitchell has had to get creative to keep his family afloat and support his employees during the pandemic.

“I realize that all of my staff, they’re in the same boat that I’m in. They have to have some type of cash coming in,” Moore said in an April 3 phone interview. “We have nothing, literally nothing.”

He says he has been working 60-hour weeks, baking bread and selling other baked goods through take-out "pop-ups" at Campbell’s Bakery in Fondren (Mon.-Fri.) and Campbell’s Craft Donuts in Belhaven (Fri.-Sat.), and sharing sales proceeds with his employees, some of whom live paycheck-to-paycheck or rent their homes. At the same time, Mitchell has been exploring what kind of governmental relief he can benefit from as a small business owner.

Payroll Protection Plan

The Payroll Protection Plan, which the government is offering to businesses in operation since before Feb. 15, offers loans of 2.5 times that business’ average monthly payroll cost, though it does contain some restrictions, such as a $100,000 salary cap per employee. If businesses use PPP funds to cover payroll, including paid sick leave, health insurance, retirement plan contributions, that portion of the loan can be forgiven, essentially turned into a grant.

Moore and his staff decided that PPP did not make sense for his business, because his employees, who are hourly, could actually get more money through unemployment. (People whose employers have laid them off or sent them without pay, or workers who have contracted COVID-19 or are caring for someone with the disease are eligible to apply for unemployment through the Mississippi Department of Employee Security.)

“We met, we talked about it as a team and decided, hey, the math is the math,” he said. “None of my people are going to stay on the payroll.”

Mitchell is now considering a disaster assistance loan through the Small Business Administration—the only other disaster relief option currently available to small business owners—although he has some reservations.

SBA Disaster Assistance Loan

Mississippi small business owners who are suffering losses due to the COVID-19 outbreak can apply for the low-interest disaster assistance loan, called the economic injury disaster loan, or EIDL, from now until Dec. 21, 2020.

Specifically for COVID-19 response, a $10,000 emergency advance is also available to businesses that apply for the loan. Businesses are not required to pay back the $10,000 advance, which essentially functions as a grant, regardless of whether or not they qualify for the loan, Jackson attorney David Humphreys confirmed Friday. (If you receive both an EIDL advance and PPP loan, some of that overall number may not be fully forgiven, Humphreys said.)

Michael Lampton of the Small Business Administration, which administers the loan, explained the process and eligibility to local business owners during a March 20 teleconference hosted by Reps. Lataisha Jackson, D-Como, and Sonya Williams-Barnes, D-Gulfport.

Business owners should assess the impact of the novel coronavirus on their operations from Jan. 31, the date the virus entered the US.

“From that period, you as a small business can look at the prior years of your operation and determine based on what may happen the remaining of this fiscal year or this calendar year, how it’s going to affect your business,” Lampton explained.

“If you are able to determine that, as a result of closures, as a result of a downturn in attendance, your customer base is maybe lowered as a result of this particular incident, then you are able to show that you are experiencing a loss in revenue, a loss in production,” Lampton said. “That will allow you to apply for this particular loan.”

Each small business owner can benefit from up to $2 million in loans for damages due to COVID-19. Interest rates vary, from 3.75% for small businesses to 2.75% for “most private nonprofit organizations,” Lampton said. Loan holders can extend repayments for up to 30 years.

COVID-19 Information Mississippians Need

Read breaking coverage of COVID-19 in Mississippi, plus safety tips, cancellations, more in the JFP's archive.

The funds can be used to pay debts, payroll, accounts payable “and any other general bills that you normally pay that you’re not able to do now because of this particular incident,” Lampton said.

“It’s not a physical loan, but a working-capital loan,” to be apportioned towards “normal and ordinary operating expenses that you would routinely be able to pay,” he explained.

Eligibility and Application

In order to be eligible for the SBA loan, businesses must be registered in the State of Mississippi and must have filed tax returns with the Internal Revenue Service as a business—whether a schedule C for sole proprietorships or a corporate tax return for corporations.

Applicants must also prove that they have experienced a loss in their revenue or production because of the COVID-19 pandemic, and they must have fewer than 500 employees.

Lampton explained that the Small Business Administration takes into account a business’ credit history in determining whether or not to approve the loan.

“In doing that, understand we are not a financial institution, even though we are considered a federal bank, but we don’t operate as your bank that you deal with on a day-to-day basis,” he said. “We’re not going to look at your credit as stringently as that bank possibly would. However we will look at your ability to … repay that loan,” he added.

That should not deter an applicant, he said, and urged all small business owners to apply regardless of their credit history.

The Small Business Administration will also work with business owners to extend payments over a long period of time, Lampton said, so that businesses will be able to pay the lowest monthly payment possible. They can defer payments for up to one year, but those that can repay the loan sooner have the option to do so.

Applicants can apply online at www.sba.gov/disaster or for the COVID-19 loan advance at covid19relief.sba.gov. They can also call 1-800-659-2955 to request a paper application and to ask questions related to the loan.

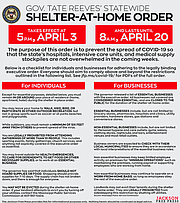

During the call, Rep. Jackson encouraged business owners to reach out to Gov. Tate Reeves to ask for additional forms of relief.

“Contact the governor’s office and make a plea for the types of programs and resources that we know you need and that you know that you need within the state aid programs that may be possible to help you all during this time,” Jackson said.

‘It Feels Like We Were an Absolute Afterthought’

Moore understands the SBA loan is one of two options the federal government has made available to small businesses, but he is concerned about the pressure it places on small businesses, many of which may already be in debt, to take out additional loans.

He is also disappointed that the federal government has protected large corporations while doing what he says is comparatively little to support small business owners who are particularly vulnerable right now.

“You’ve got bail-outs for big business,” he pointed out. “They don’t actually have to physically pay that back, but for us, for small business people, their solution is, ‘here you go, take a loan.’ Well, I don’t want to take a loan,” he said. Moore explained that he is already in debt as a result of opening his newest business, and now that he finally owns his two other businesses, he is hesitant to go into debt again.

“Why do I want to go into debt for a 9-year-old business, just to re-open it, when I didn’t do anything to close it, and it just closed because people stopped coming in?” Mitchell asked.

“I am already in debt. You now have to go further into debt? What sense does that make?”

Though he lauded lawmakers for bridging partisan lines and coming to a swift decision, Mitchell wishes that they had more carefully considered the scope of the pandemic’s impact on small businesses.

“I’m really disappointed that this is the solution that they came up with, out of 2 trillion dollars,” he said. “They thought about servers and people who had lost their jobs, and they thought about big business. But the small business, it feels like a throwaway,” he said.

“It feels like we were an absolute afterthought,” Mitchell said.

‘Nobody Could Have Planned for This.’

Humphreys advised small business owners to reach out to their accountants and attorneys and immediately apply for relief through PPP or the SBA loan.

“I know CPAs are working around the clock right now to assist their clients with this, so I would encourage (business owners) to talk to their accountants and get advice from their accountant and their attorneys,” he said.

Humphreys also said that he fears additional fall-out from the pandemic, including impending litigation around people who have been forced to go to work sick. Employees should ask their employers what measures they have in place to prevent workers from contracting COVID-19.

He urged businesses to prepare as much as they can for the challenges ahead and acknowledged that the last few weeks have blindsided everyone.

“We advise clients all the time you need to be prepared for a slowdown, have a couple of months’ worth of expenses and cash set aside. But no one could have predicted this,” he said. “The economy coming to a screeching halt (in what) seems like in a matter of a few hours a few weeks ago.”

“That’s my biggest worry, is nobody planned for this. Nobody could have planned for this,” he said.

Read the JFP’s coverage of COVID-19 at jacksonfreepress.com/covid19. Get more details on preventive measures here. Read about announced closings and delays in Mississippi here. Read MEMA’s advice for a COVID-19 preparedness kit here.

Email information about closings and other vital related logistical details to [email protected].

Email state reporter Nick Judin, who is covering COVID-19 in Mississippi, at [email protected] and follow him on Twitter at @nickjudin. Seyma Bayram is covering the outbreak inside the capital city and in the criminal-justice system. Email her at [email protected] and follow her on Twitter at @seymabayram0.

Comments

Use the comment form below to begin a discussion about this content.

Sign in to comment

Or login with:

OpenID