Originally published November 28, 2012 at 12:49 p.m., updated November 29, 2012 at 6:05 p.m.

True or False? Allowing the Bush-era tax cuts to expire for the wealthy will increase unemployment.

Tax cuts are like power: Once people have some, wresting it out of their hands makes for a battle royale. Yet, reversing the Bush-era tax cuts for the wealthy summarizes President Barack Obama's re-election campaign for many Americans: Those that have quite a lot should pay a little more.

What many folks forget is that the tax cuts Congress enacted in 2001 and 2003 were never supposed to be permanent; they were meant to provide boosts to economies in recession. Both had a December 2010 expiration date. Obama temporarily extended the temporary cuts for two years in 2010, mostly as a concession to get a bigger, more comprehensive tax and economic stimulus bill passed.

Who Wants What?

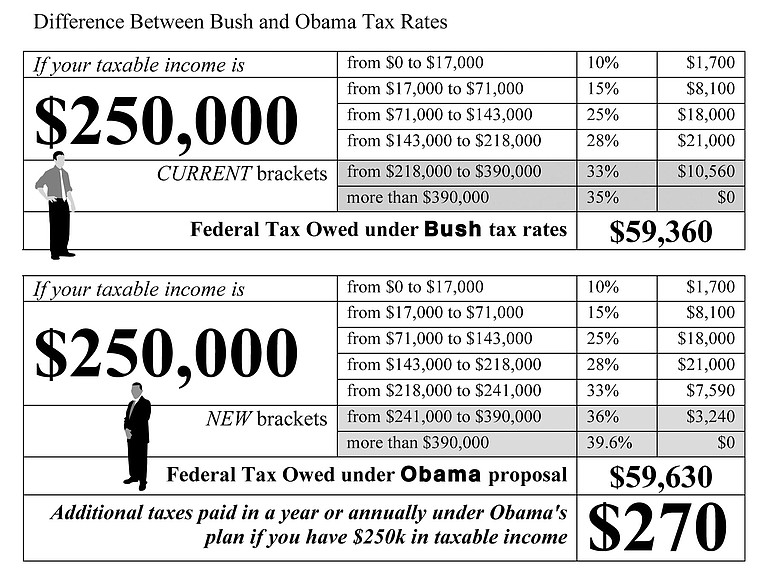

• The Obama administration is pushing to have the wealthy--those with household incomes of $250,000 or more ($200,000 for individuals)--revert to the Clinton-era tax rates (from the current top marginal rate of 35 percent to 39.6 percent). In other words, let the Bush cuts expire, but only for the folks at the top 2 percent of the earnings scale.

• Republicans fall back on the argument that increasing taxes on the wealthy will increase unemployment. Fully half of small businesses will see higher tax rates, they say--the same small businesses that create jobs. Conservative media outlets (notably FOX News) have enthusiastically pushed that meme for years.

And the Experts Say ...

The problem with the conservative meme about small businesses is the economists' consensus--from organizations such as the nonpartisan Congressional Budget Office and Congressional Research Service--says it's not accurate. Upping marginal tax rates for the wealthy will not negatively affect half of America's small businesses. Most agree that only about 3 percent will see an increase. How can that be?

First, the word "marginal" is important. No one will be automatically bumped into a higher tax bracket if his or her taxable income goes over $250,000. Only the portion of income exceeding $250,000 would see that small 4 percent increase. Marginal tax rates on income from $1 to $249,999, under Obama's plan, would remain the same.

Second, "taxable" is important. Business expenses--including the cost of inventory, payrolls, rent, legal fees, supplies and hundreds of other necessities--come right off the top before businesses figure their tax liability. What's left--and for many businesses, that amount can be zero or even a negative number--is taxable.

Third, it's important to note that businesses don't expand or contract because of marginal tax rates. Businesses hire people because their customers demand more of what they have to sell--more customers, more products, more hiring. Math.

The Congressional Budget Office put it this way: "Increasing after-tax income of businesses typically does not create much incentive for them to hire more workers in order to produce more, because production depends principally on their ability to sell their products."

"Less than 3 percent of tax filers with any business income make over $200,000 (individual) or $250,000 (couples) per year," wrote the American Sustainable Business Council and Business for Shared Prosperity in a petition to Congress. The petition is an effort to convince Congress to allow the tax cuts expire on incomes over $250,000.

What Is a Small Business?

The U.S. Small Business Administration defines small business as "one that is independently owned and operated, is organized for profit, and is not dominant in its field. Depending on the industry, size standard eligibility is based on the average number of employees for the preceding 12 months or on sales volume averaged over a three-year period."

The SBA has a fairly large idea of what constitutes "small," but suffice to say that small businesses aren't all mom-and-pop operations or even companies with 20 or 30 employees. Manufacturers with 500 to 1,500 employees (depending on the product), for example, are "small" businesses. Receipts for service "small" businesses are somewhere south of $2.5 million to $21 million, depending on sector.

In 2008, 21.4 million (78 percent) of America's 27.3 million businesses had no employees, according to U.S. Census data. These companies could be any number of owner-operated enterprises from a one-woman tech repair to freelance designers to lobbyists, hedge-fund managers and pass-through corporations established to rent out a vacation home. Just over 38,900 companies exceeded 500 employees, or 0.014 percent.

Who Do the Bush Tax Cuts Affect?

The cuts lowered tax rates across the board, decreased the marriage penalty and increased the child tax credits. Those with higher incomes, however, did especially well. The cuts lowered capital-gains taxes, eliminated higher-income phase-outs of personal exemptions and itemized deductions, and eliminated the estate tax.

Tax Cut Positions

• The conservative argument is that the cuts put more money into American pockets, thus buffering the economy from a more dismal freefall than it actually took.

• The centrist argument is that the cuts, enacted at the start of two wars, added to the federal deficit (and consequently the debt, which can be thought of as accumulated deficits).

• On the left, opponents specifically of cuts for the wealthy, argue that the cuts increased income inequality and decreased public services to all Americans.

Fiscal Cliff?

Because of its inability to come to a budget agreement last summer, Congress enacted a bill that would not only end the cuts ("taxmageddon" in some circles), it would also make indiscriminate, ham-handed cuts to all areas of the federal budget if Washington can't agree on a new budget by the end of this year. The media dubbed this automatic drubbing of the budget the "fiscal cliff."

CORRECTION: A previous version of this story reversed the terms "debt" and "deficit." We apologize for the error.

Comments

brjohn9 11 years, 4 months ago

The absurdity of the conservative argument on marginal tax rates was nicely lampooned in http://www.nytimes.com/2012/11/26/opi...">Warren Buffet's recent New York Times column.

SUPPOSE that an investor you admire and trust comes to you with an investment idea. “This is a good one,” he says enthusiastically. “I’m in it, and I think you should be, too.”

Would your reply possibly be this? “Well, it all depends on what my tax rate will be on the gain you’re saying we’re going to make. If the taxes are too high, I would rather leave the money in my savings account, earning a quarter of 1 percent.” Only in Grover Norquist’s imagination does such a response exist. ...

He concludes: In the meantime, maybe you’ll run into someone with a terrific investment idea, who won’t go forward with it because of the tax he would owe when it succeeds. Send him my way. Let me unburden him.

RRArch 11 years, 4 months ago

It was my assumption the tax hike is for only taxable income above $250K thus minimal change. BUT let's look at taxable income above that threshold, say #300K. That $50K is subject to the higher rate, or $4,740 increase or more specifically a 9.5% tax increase.

THUS, a tax liability under the existing rate for $300K is $75,860 and under the proposed rate increase is $80,870. Comments? ? ? ?

tstauffer 11 years, 4 months ago

@RRArch I don't follow what you're saying... I'm getting different numbers, unless I'm missing something.

The taxable income above $241k would be taxed at 36%; so, rounding, that ~$60k would require another ~$1800 or so in taxes over what you'd currently pay.

The numbers I get are $75,860 under current law and $77,630 under new rates.

RonniMott 11 years, 4 months ago

Buffet's comments make a great exclamation point, Brian. Thanks.

RichardASunCFA 11 years, 4 months ago

Buffet's written record make it clear his investments have been made and analyzed on an after-tax basis, including his charitable contributions. In fact, at the corporate level, it would be a breach of his fiduciary obligations to shareholders to do otherwise. (His ownership share of Berkshire Hathaway makes it difficult to complete separate his personal tax situation from the company's.)

No question Buffet is a savvy and successful investor, but his public policy prescriptions don't seem to follow from and, in fact, appear to contradict his investment work as documented in his writing going back over a long period. See the recent Forbes blog; I don't know if you can access it without a subscription, but confirmation is readily available at:

http://www.forbes.com/sites/realspin/...">http://www.forbes.com/sites/realspin/...

Among the Buffet quotes in the column are:

“I am an outspoken advocate of paying large amounts of income taxes – at low rates.”

“My net worth is the market value of holdings less the tax payable upon sale. The liability is just as real as the asset unless the value of the asset declines (ouch), the asset is given away (no comment), or I die with it….Investment decisions should be made on the basis of the most probable compounding of after-tax net worth with minimum risk.” [emphasis added]

Also from the Forbes column: "In 1984, he discussed a new investment that he had made in the bonds of the Washington Public Power Supply System (WPPSS):

"In the case of WPPSS, the “business” contractually earns $22.7 million after tax (via the interest paid on the bonds), and those earnings are available to us currently in cash. We are unable to buy operating businesses with economics close to these. Only a relatively few businesses earn the 16.3% after tax on unleveraged capital that our WPPSS investment does and those businesses, when available for purchase, sell at large premiums to that capital."

So it would appear that the Sage of Omaha does not invest just to meet customer demand, but to make an after-tax return. And as his results indicate he is very good at making sure that his pre-tax returns are attractive after-tax returns as well. All legal (as far as we know), savvy and laudable especially since he has backed the growth of numerous businesses (presumably creating some jobs in the process) and committed to make massive charitable contributions from those returns.

Richard A. Sun, CFA

RichardASunCFA 11 years, 4 months ago

For those interested in the challenges facing young and/or small business the following Brookings Institute event might be of interest; from the Brookings website it appears a podcast and presentation slide-deck and podcast will be available.

Promoting Innovative Growth: Venture Capital, Growth Equity and IPOs Young companies have been shown to be a crucial driver of employment growth and innovation in the American economy. Yet in recent years, these critical firms have struggled to raise capital. Venture capital funding—the major funder of technologically innovative firms—has never recovered from its peak in 1999-2000. Many smaller growth equity funds have struggled to raise capital as large institutions concentrate their funding into fewer funds, seeking to limit the number of relationships they must manage. Meanwhile, the path from private to public ownership has become more daunting. In response to these circumstances, Congress—in a rare display of bipartisanship—enacted the JOBS Act, which relaxes the barriers that small firms face when going public and facilitates the raising of capital through “crowdfunding.” But it remains to be seen the extent to which these policies will ease the financing challenges facing high-potential firms.

On December 3, Economic Studies at Brookings and the Private Capital Research Institute will examine the challenges that the financing system faces, recent changes, and the likely future of entrepreneurial finance.

Richard A. Sun, CFA

scrappy1 11 years, 4 months ago

So far the budget deals are all about spending and tax increases. Except for the Obama admin's request for more stimulus to reward his supporters like he did with Solyndra. While being totally ignored are jobs that could be allowed or not blocked by the Obama administration. When Obama first swooped into office the first thing he did was begin canceling oil leases. State and private land escaped his control and he has been looking for ways to stop it since. A budget deal with this president should include curbing in the EPA and allowing energy jobs to flourish. Tax rates, labor costs and energy costs drive business. President Obama has been attacking business at all levels. He doesn't want to feed the Golden Goose and keep it producing, he wants to roast the Goose and spend the wealth of the nation down to nothing. North Dakota is an example of what could be taking place in many more areas of the US, including Utah, Alaska, the Gulf, and with the Keystone pipeline. Menards is flying in workers from Wisconsin to staff their building supply store in Minot,ND because the oil boom and associated boom in construction and every related support business in ND has taken every available worker. You want more tax revenue stop killings jobs Mr. President! I have several friends and relatives that are grossing more than 100K a year and paying combined federal and state taxes of over 30K a year. If this President doesn't allow private enterprise to creat more jobs then his tax and spend policies will destroy this country.

tstauffer 11 years, 4 months ago

@scrappy --

(a.) the budget proposals focus on tax rates because the "fiscal cliff" is timed to begin hitting at the beginning of the year when the Bush tax cuts are set to expire. So, by necessity, that is what they're focused on.

(b.) there's been a boom in domestic oil and gas production -- some argue an all-time high -- that lead to the labor shortages you're talking about. And a lot of the boom in natural gas is because it's now more competitive with other fossil fuel options.

(c.) the leases that were cancelled in 2009 were in Nine Mile Canyon, Arches National Park and Dinosaur National Monument, already had a Federal judge's injunction as they hadn't been properly cleared with the National Park Service. It could easily be argued that the Bush admin was irresponsible in granting them, pushing through some pork late in their administration.

(d.) The Keystone Pipeline is designed to move Canadian oil (not U.S.) to our refineries in the South. Obama encourages the construction of the southern portion of the pipeline in March and is set to consider approval of the international portion as it's been rerouted to deal with earlier objections.

(e.) Discretionary spending is down considerably under Obama including the $917 billion (over 10 years) in cuts in the DCA 2011. The money being spent these days is on defense and security, entitlements and interest on the debt. Just take a quick look at something like this -- http://useconomy.about.com/od/usfeder...">http://useconomy.about.com/od/usfeder... -- might be a useful reference before going off on a rant about "Obama's spending." Only 1/3 of discretionary spending is spent on non-defense/security, thanks to two wars and entirely new departments (Homeland Security) under by George W. Bush. It's time to understand the dramatic re-set in our budget in the past 12 years.

(f.) Your friends "grossing" over $100k (do you mean "netting") and paying $30k in taxes won't see their tax burden increase under any "fiscal cliff" proposal I've seen.

brjohn9 11 years, 4 months ago

Richard, you're swimming in the details and missing the point. Obviously, Buffet would consider how taxes would affect an investment. But he's ridiculing the caricature that conservatives have created, in which increasing the top tax rate by 4.6 percent will bring about economic apocalypse. As the CBO and other analyses have shown, small changes in the top tax rate have very little impact on economic activity.

RichardASunCFA 11 years, 4 months ago

brjohn--OK, then if investors and business people do their analysis after tax, and taxes on investments and businesses are raised, then the lower returns from the tax increases creates a group of investments that won't be made because they no longer satisfy the required after-tax rate of return.

If you run the numbers, as I have, you find your after tax returns dropping far more than you guess from the magnitude of the change in ordinary tax rate--the change in tax rate is magnified over the investment period by compound interest, lower growth rate, lower multiple on sale, and much higher cap gains tax rates (23.8 versus 15%).

CBO generally operates under static analysis which does not take into account how participants respond to changes in tax law and all other factors the dreaded assumption that all other factors are the same, which they aren't). Given the political constraints under which it operates, the CBO scores, it does not in the truest sense predict. Sit down with one of their staff and they will be the first to state the limitations of what they do. They are bright, bipartisan, well trained and well educated, but they operate with a set of arbitrary assumptions set by Congress with the political process driving not the investment process. The greater the proposed changes, the more significant those constraints become and the greater the potential deviantion been the scoring and what actually happens in the future.

brjohn9 11 years, 4 months ago

All of that may be true, Richard, but none of it makes a strong argument for large economic effects from a 4.6 percent increase in the highest marginal tax rates.

RichardASunCFA 11 years, 4 months ago

Don't view this in isolation: 1) Obabamacare contained an increase of 3.8% on capital gains income, 2) this proposal is round two, 3) when we tackle entitlement reform, taxes on the over 200/250K group will be raised again (can you imagine a tax increase without that group being the prime target).

So any rationale investor considers not just what Obama has done so far and what he is proposing but what he will do in the future.

So it is not whether taxes will be raised on the over 200/250K group, it is when and how much.

Sign in to comment

Or login with:

OpenID