Wednesday, December 19, 2012

The federal poverty threshold is a calculation based on the cost of food in “nutritionally adequate diets” for a family of three, developed in the early 1960s by Mollie Orshansky of the Social Security Administration. The baseline assumption is that a family of three will spend about a third of its income on food.

Although lots of folks have tinkered with the formula and the numbers have been updated in line with the Consumer Price Index, the baseline assumption has not changed since the ’60s.

Critics point out that the poverty threshold is, at best, outdated and inaccurate for many people. It doesn’t account for costs that have risen faster than food, such as housing, transportation, health care or child care, nor is it indexed for different parts of the country with widely varying costs of living (although the threshold is slightly higher for Alaska and Hawaii).

The World Bank suggests that only measuring poverty provides an incomplete picture of how people fare. In addition to poverty (which it defines as whether households or individuals have enough resources or abilities to meet their needs), the World Bank includes measurements of inequality (the distribution of income, consumption or other attributes across the population) and vulnerability (the probability or risk of being in poverty—or falling deeper into poverty—in the future) for a more complete picture of people’s well-being.

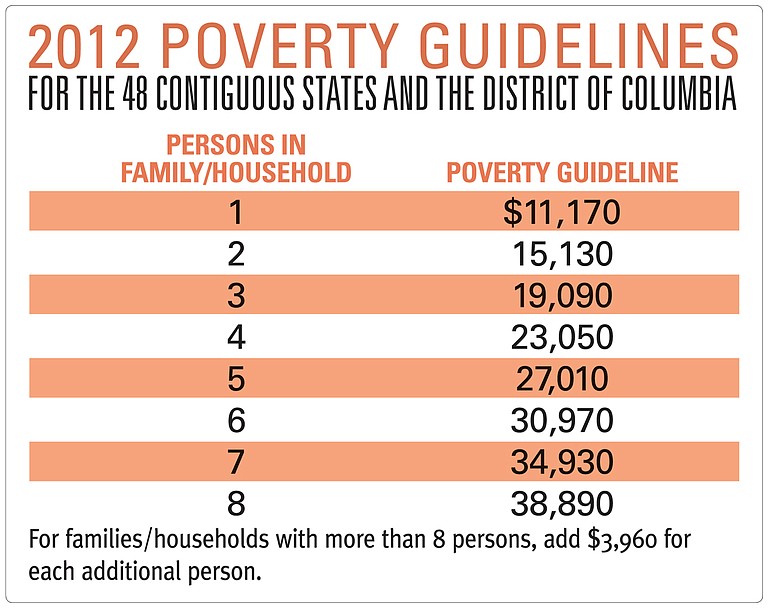

U.S. poverty guidelines are simplified versions of the poverty threshold used for administrative purposes, such as qualifying people for federal aid. The 2012 poverty guidelines for all states except Alaska and Hawaii are below.

A family of four with an income of $23,050 has a monthly income of $1,920, or about $443 per week. A single person with an income of $11,170 has a monthly income of $931, or about $215 per week.

A person earning the federal minimum wage of $7.25 per hour provides a person working 40 hours per week gross wages of $290 a week, or $15,080 per year.

Comments

Use the comment form below to begin a discussion about this content.

Sign in to comment

Or login with:

OpenID